Dealing with your No-Fault insurance company after a car accident can be a headache, to say the least. Although an experienced car accident lawyer can help guide you through the process, the below steps can assist in expediting payment of your New York No-Fault lost wage payments. Here are four steps you can take right away to begin obtaining your New York No-Fault lost wage payments:

Step 1: Complete the Lost Wage Section on Your NF-2 New York Application for No-Fault Benefits

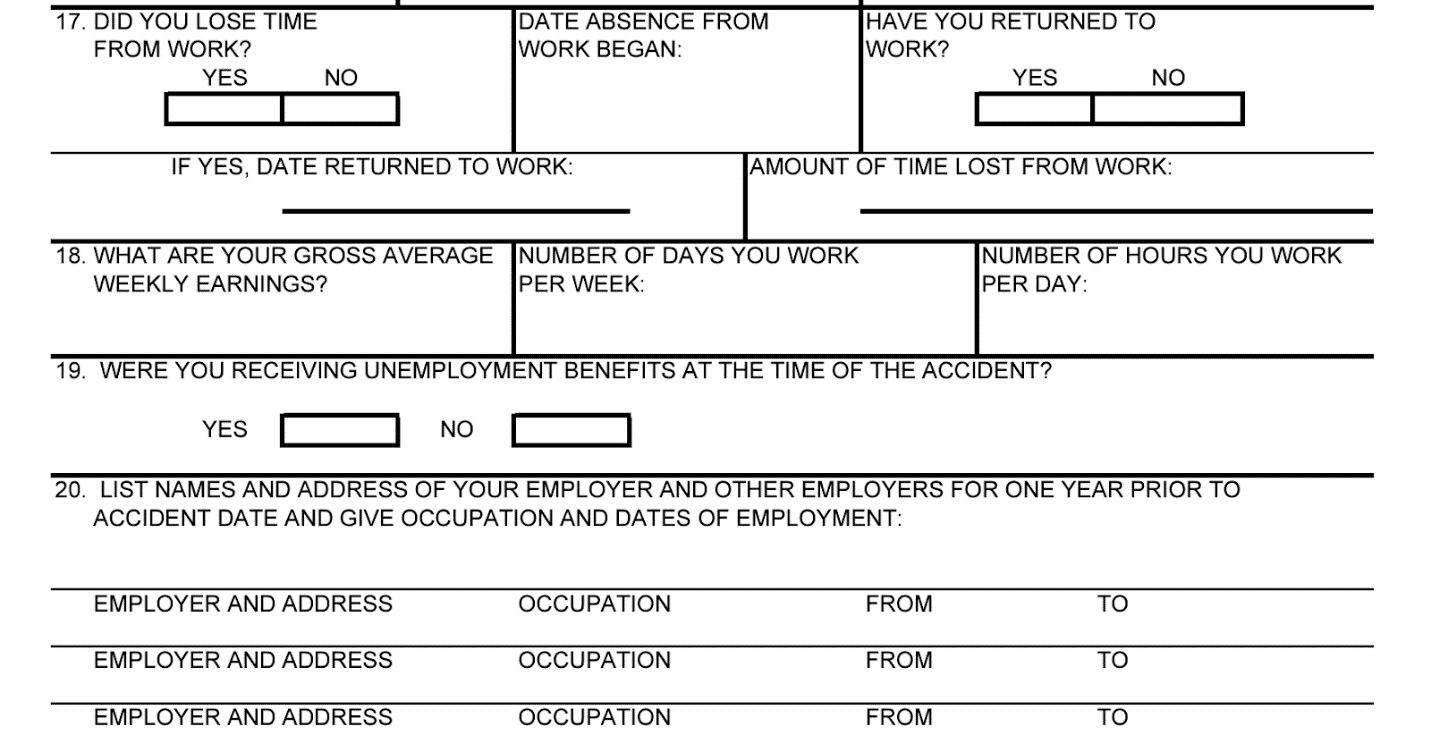

Within 30 days after the accident, you must provide your No-Fault insurer with written notice you sustained injuries in an accident. On the NF-2 Application, there is a section that specifically addresses lost wages. Make sure to complete this section in its entirety. When this form is submitted, it will place your No-Fault insurer on notice of your lost wage claim. You must still submit additional information, however, to finalize your lost wage claim, so make sure to complete the additional steps in this article.

Here’s an image of that section from the standard New York State NF-2 Form:

Step 2: Have Your Employer Complete an NF-6 Employer Wage Verification Report, OR If You’re Self-Employed, Complete an NF-7 Verification of Self-Employment Form

The next step in obtaining your No-Fault lost wage payment is to have your employer complete the NF-6 New York State Employer Wage Verification Report. It's a simple, two-page document that provides details about your employment. Provide your employer with the contact information for your No-Fault insurance adjuster and have them send the form by fax directly to their offices. You can obtain a copy of the NF-6 form here.

Important: We highly recommend you ask your employer to provide you with a completed and signed copy of the NF-6 form, in addition to having them send it to the insurance company. This way, if the No-Fault insurer does not receive the form, you can provide it to your lawyer and have them resend it instead of asking your employer to resend and confirm the receipt.

If you are self-employed, you will instead complete the NF-7 New York State Verification of Self-Employment Form regarding the details of your self-employment. It’s best to provide this form directly to your lawyer and have their office send it so it’s confirmed by fax or certified mail that it was sent timely to your No-Fault insurance company. You can obtain a copy of the NF-7 form here.

Step 3: Obtain a Disability Note From Your Treating Medical Provider

In order to receive your No-Fault lost wages, in addition to submitting an NF-6 or NF-7 form, you must also obtain a disability note from your doctor stating you are unable to return to work. This note must be sent directly to your No-Fault insurance company. It’s best to submit the disability note by fax to the No-Fault adjuster handling your claim to confirm timely receipt.

The disability note will only be effective for a maximum of 30 days. This means even if your doctor writes a disability note for a much longer time period, you must still obtain an updated disability note and submit it to your No-Fault insurance company every 30 days or they will not issue payment.

Step 4: Apply For Short-Term Disability Benefits Through Your Employer

In New York, the No-Fault insurer is allowed to take an offset for payments made by your short-term disability through your employer. If you do not also timely apply for those benefits, the No-Fault insurer will nonetheless take advantage of this offset and reduce your lost wage payments. Contact your employer immediately to obtain additional information on how to apply for and obtain these benefits.

Conclusion

Trying to understand the maze of deadlines and documents to secure your No-Fault benefits can be overwhelming. The Learn the four steps to obtain lost wage payments from your New York No-Fault insurance. The experienced attorneys at Horn Wright, LLP are here to help., are experienced in all aspects of New York’s No-Fault laws. With a simple phone call, you can speak with an attorney within minutes to discuss your car accident case today. Call now.